S&P 500 reacts to trade negotiations

Anúncios

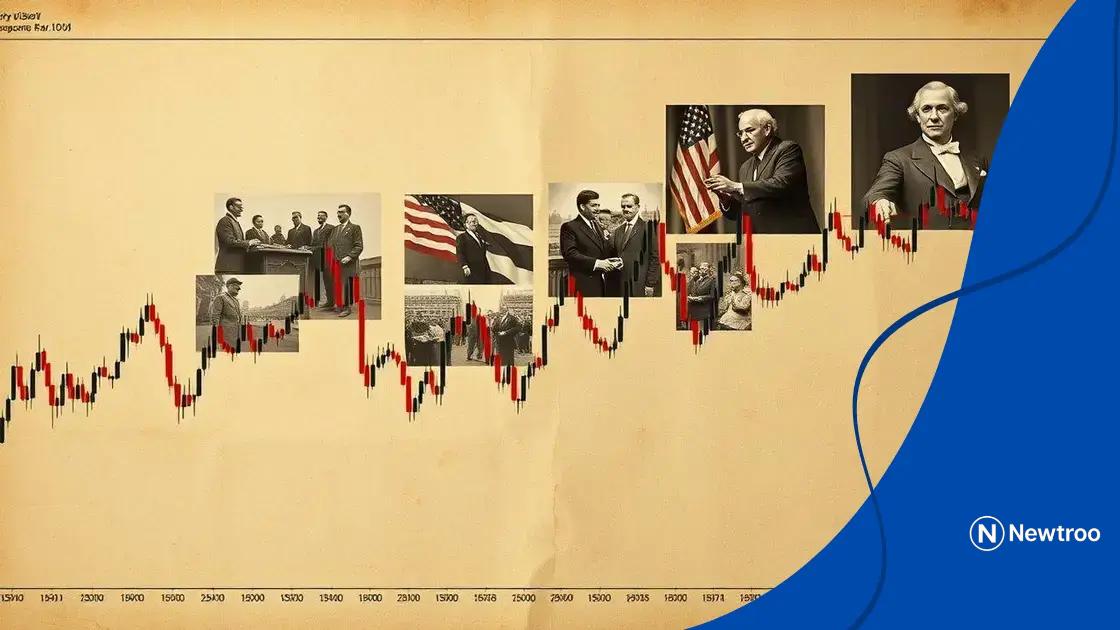

The S&P 500 reacts significantly to trade negotiations, with positive outcomes boosting investor confidence and negative developments often leading to market volatility.

S&P 500 reacts to trade negotiations in ways that can surprise even the most seasoned investors. Have you ever wondered how these negotiations shape market dynamics and investor behavior? Let’s dive into this crucial topic.

Anúncios

Understanding the S&P 500 Index

The S&P 500 Index represents a snapshot of the U.S. stock market and is one of the key indicators of its performance. It comprises 500 of the largest publicly traded companies in the United States and reflects the overall health of the economy.

This diversification helps investors gain a clearer picture of market trends without having to analyze individual stocks. Understanding how the S&P 500 works can aid you in making informed investment decisions.

Structure of the S&P 500

The S&P 500 is divided among various sectors, including technology, healthcare, and finance. Each sector’s performance affects the index’s overall movement. Here’s a quick overview:

Anúncios

- Technology: Includes major players like Apple and Microsoft.

- Healthcare: Comprises companies providing medical services and products.

- Financials: Features banks and financial services that shape the economy.

When you analyze the S&P 500, consider how these sectors interact. For instance, when technology stocks rise, they can lift the entire index. Additionally, this index is weighted by market capitalization. This means larger companies have a more significant impact on the index’s value than smaller ones.

Why It’s Important

The S&P 500 is vital for several reasons. It serves as a performance benchmark for many mutual funds and ETFs. Investors often use it to gauge market health and predict future trends.

By following the index, you can also understand investor sentiment. A rising S&P 500 may indicate confidence in the economy, while a declining index can signal concerns. Knowing these nuances can inform your investment strategy.

In summary, the S&P 500 is not just a number; it reflects the economic landscape. Whether you are a seasoned investor or new to the market, grasping its structure and importance can empower your financial decisions.

The impact of trade negotiations on stock markets

Trade negotiations play a crucial role in shaping the dynamics of stock markets. When countries discuss tariffs and trade agreements, these talks can lead to significant fluctuations in market values. Understanding these impacts is essential for investors looking to navigate the volatile landscape.

A positive outcome in trade negotiations can boost investor confidence, leading to a rise in stock prices. On the other hand, negative developments can trigger panic selling, causing prices to plummet.

Key Factors Influencing Markets

There are several factors to consider when evaluating how trade negotiations affect stock markets:

- Investor Sentiment: Market reactions often reflect how optimistic or pessimistic investors feel about the future.

- Sector Vulnerability: Different sectors respond differently. For example, technology stocks may react more vigorously to trade talks than consumer goods.

- Global Economic Indicators: Broader economic indicators can influence how trade news is perceived.

This complex interplay can create a web of reactions. For instance, if trade talks hint at favorable terms, sectors like agriculture or manufacturing may see immediate benefits. Conversely, any delays or misunderstandings often lead to uncertainty and can depress activity in the markets.

Historical Context

Historically, major trade agreements have led to notable shifts in stock market performance. The North American Free Trade Agreement (NAFTA) provides a key example; its implementation saw substantial growth in relevant sectors. Similarly, trade tensions can result in profound impacts, often echoing through various global markets.

It is important to remember that while trade negotiations do influence stock prices, they are not the only factor. Economic data, interest rates, and corporate earnings also play significant roles. Therefore, staying informed on multiple fronts is vital for making sound investment decisions. Keeping track of news related to trade negotiations will allow investors to better anticipate moves in the stock markets.

Historical trends in market reactions

Historical trends in market reactions can provide valuable insights into how the stock market responds to various events. Analyzing past behaviors helps investors anticipate future trends, particularly during times of uncertainty.

The stock market often reacts sharply during significant events, such as elections or economic reports. For example, in the wake of major trade deals or negotiations, stocks have frequently experienced notable volatility.

Patterns of Market Activity

Some usual patterns emerge when examining historical data:

- Immediate Reactions: The stock market typically reacts quickly to news. Often, prices move significantly within hours or even minutes of an announcement.

- Long-Term Outcomes: Initial reactions may not reflect the long-term consequences. Markets might stabilize over time as investors assess the full impact of news.

- Sector-Specific Reactions: Different sectors respond uniquely to events. For instance, technology stocks may surge after favorable trade news, while agriculture stocks might face declines due to tariffs.

Another interesting aspect of historical trends is the concept of market resilience. Many markets bounce back after sharp declines, often due to investors recognizing value. This has been seen in various instances following trade negotiations and economic announcements.

Looking Back on Key Events

Key events in history demonstrate how the market has responded. For instance, the announcement of trade agreements often leads to short-term stock increases as companies predict greater profits. Conversely, breakdowns in negotiations may cause investors to panic, wiping out gains.

By understanding these historical trends, investors can better position themselves during similar future events. Staying informed about how the S&P 500 and other indices historically react allows for more strategic decision-making in volatile times.

Expert opinions on trade developments

Expert opinions on trade developments are essential for understanding how markets are likely to react. Financial analysts and economists closely follow negotiations to anticipate shifts in the stock market. Their insights can help investors make informed decisions.

Experts often analyze aspects like tariff changes, trade agreements, and their potential impacts on different sectors. For instance, when tariffs increase, industry experts evaluate how companies in the affected sectors may respond.

Insights from Financial Analysts

Financial analysts provide critical insights that can guide investors:

- Market Predictions: Analysts use data and historical trends to predict how markets will respond to new trade policies.

- Sector Focus: Different sectors react variously; some may benefit from trade deals, while others may suffer losses.

- Risk Assessments: Experts assess potential risks tied to trade negotiations, allowing investors to make better choices.

In recent discussions about potential trade agreements, many analysts have pointed out that technology and manufacturing sectors often face the most significant impacts, since they are directly affected by tariff changes.

Opinions from Economists

Economists also weigh in on trade matters, emphasizing the broader implications of such negotiations. They analyze how trade agreements could stimulate or hinder economic growth. Some economists argue that reducing tariffs could boost consumer spending, while others warn of potential job losses in certain industries.

In addition to forecasts, economists often discuss the importance of maintaining strong international relationships. They believe that stable trade relationships can enhance market conditions and support long-term growth.

Listening to expert opinions on trade developments is crucial. Their insights help shape investor strategies, providing a clearer picture of how trade discussions impact the S&P 500 and other major indices.

Future outlook for the S&P 500

The future outlook for the S&P 500 is a topic of great interest for investors and financial analysts. As the stock market continues to react to various external factors, understanding potential future trends can guide investment strategies.

Several conditions influence the outlook of the S&P 500. Economic growth, interest rates, and ongoing trade negotiations hold significant sway. For example, if the economy shows signs of robust growth, it typically bolsters the index’s performance. Conversely, high interest rates may create challenges.

Economic Indicators to Watch

Monitoring key economic indicators provides insight into the likely direction of the S&P 500:

- GDP Growth: A strong Gross Domestic Product (GDP) signals a healthy economy and often correlates with stock gains.

- Employment Rates: Low unemployment usually boosts consumer spending, benefiting companies within the index.

- Inflation Levels: Stable inflation levels can lead to more favorable conditions for business growth.

These indicators offer a snapshot of economic health and can help predict market behavior. Investors keenly assess these trends to adjust their portfolios accordingly.

Trade Negotiations and Market Sentiment

Additionally, ongoing trade negotiations have an essential role in shaping the future of the S&P 500. Positive developments in trade relations often inspire confidence, leading to upward trends in the stock market. Alternatively, setbacks in negotiations can fuel uncertainty, causing volatility.

The sentiment surrounding trade can ripple through sectors differently. Technology and financial companies, for example, may be more sensitive to changes in trade policy than consumer goods companies. Hence, keeping a close eye on trade discussions is vital for predicting potential movements in the index.

Overall, while the future outlook of the S&P 500 is influenced by multiple factors, staying informed on economic trends and trade developments helps investors strategize wisely. By understanding these aspects, they can navigate a rapidly changing financial landscape.

FAQ – Frequently Asked Questions about the S&P 500 and Trade Negotiations

How do trade negotiations affect the S&P 500?

Trade negotiations can lead to fluctuations in the S&P 500, as positive outcomes boost investor confidence, while negative news can lead to declines.

What economic indicators are important for predicting S&P 500 movements?

Key indicators include GDP growth, employment rates, and inflation levels, as they reflect the overall economic health and influence market sentiment.

Why should I pay attention to expert opinions on trade developments?

Expert opinions provide valuable insights into market predictions and risks, helping investors make informed decisions regarding their portfolios.

Can historical trends in the S&P 500 inform my investment strategy?

Yes, analyzing historical trends can help identify patterns and inform strategies to navigate future market movements effectively.